In the next few weeks, children throughout the Golden State will bid farewell to the unstructured freedom that summer affords as they head back to rule the corridors and classrooms of their local schools. For public school teachers, the new school year offers a respite from this summer of discontent. The continuing recession has thinned their ranks a bit, leaving many feeling beleaguered by layoffs and budget cuts. Additionally, the effort to identify underperforming teachers by parsing standardized testing data seems to assign all of the blame for failing students on the teachers alone.

Of course, the teachers, who serve on the instructional front line, are the most visible faces in the educational system. But, we should not forget the men (and women) behind the curtain: the members of the state senate and assembly.

Considering the amount of attention that our dear Congress devotes to children, I am quite surprised by the

Considering the amount of attention that our dear Congress devotes to children, I am quite surprised by the  Earlier this month, I wrote about Amazon

Earlier this month, I wrote about Amazon

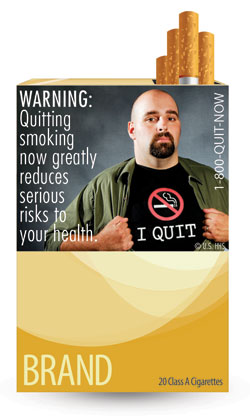

Today, the Food and Drug Administration published its final rule on

Today, the Food and Drug Administration published its final rule on

Last Sunday, our nation celebrated

Last Sunday, our nation celebrated